Stock prices have always been influenced by a variety of factors, including economic conditions, investor sentiment, global events, and corporate performance. The stock market is known for its volatility, with prices rising and falling in response to different forces. Understanding the history of stock price movements can help investors make better financial decisions.

Early Stock Market Volatility

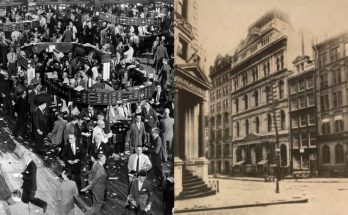

The stock market dates back to the 17th century when the first stock exchange was established in Amsterdam. Over the centuries, financial markets have experienced many periods of extreme price movements. The first notable market crash occurred in 1720 with the South Sea Bubble, where excessive speculation caused stock prices to skyrocket before a sudden collapse.

The Great Depression and Market Collapse (1929)

One of the most significant stock market declines in history happened in October 1929, leading to the Great Depression. The stock market had been experiencing rapid growth in the 1920s, fueled by speculative investments and easy credit. However, when panic selling began, stock prices plummeted, wiping out billions in wealth and causing a global economic downturn that lasted for a decade.

Post-War Growth and Corrections

After World War II, global economies rebounded, and the stock market saw steady growth. However, markets remained vulnerable to corrections, such as the Black Monday crash in 1987, when the Dow Jones Industrial Average dropped 22% in a single day due to computerized trading and investor panic. Despite this, the market recovered quickly, demonstrating resilience.

The Dot-Com Bubble and 2008 Financial Crisis

In the late 1990s, the rise of internet-based companies led to the dot-com bubble, where technology stocks surged to unsustainable levels. By 2000, many overvalued tech stocks collapsed, leading to a market downturn. Similarly, in 2008, the financial crisis triggered another major decline. The collapse of Lehman Brothers and the subprime mortgage crisis led to a severe market crash, with global stock indexes losing nearly 50% of their value.

Recent Market Volatility

In recent years, stock markets have experienced significant fluctuations due to global events. In 2020, the COVID-19 pandemic caused a massive stock sell-off as economies shut down. However, the market rebounded quickly, driven by government stimulus and the rise of technology stocks. More recently, inflation concerns, geopolitical tensions, and interest rate hikes have led to increased market uncertainty.

Stock prices will always fluctuate due to economic cycles, investor sentiment, and global events. While history shows periods of extreme highs and lows, long-term investments in strong companies and diversified portfolios tend to yield positive returns. Understanding past stock market trends can help investors navigate future uncertainties with greater confidence.