The Hong Kong Stock Exchange (HKEX) is one of the world’s leading financial markets, playing a crucial role in global trading and investment. Its journey from a small regional market to a global powerhouse reflects the economic evolution of Hong Kong itself.

Early Beginnings (19th Century – 1940s)

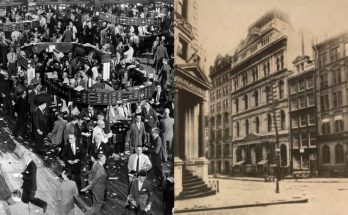

Hong Kong’s financial market traces its roots back to 1866, when the first informal securities trading took place. At the time, Hong Kong was a growing British colony and a major trading hub in Asia. However, there was no formal stock exchange, and businesses conducted stock trading privately among merchants and financial institutions.

The city’s first official exchange, the Association of Stockbrokers in Hong Kong, was founded in 1891. This organization later became the Hong Kong Stock Exchange in 1914. However, trading remained relatively small-scale, with only a few listed companies, mainly British-owned banks and trading firms.

Expansion and Competition (1940s – 1980s)

During World War II, the Hong Kong market faced disruptions, but it recovered quickly after the war. The post-war economic boom led to increased investor interest, and more companies sought listings. In 1921, a second exchange, the Hong Kong Stockbrokers’ Association, was established. The two exchanges operated separately for decades, creating competition.

By the 1970s, Hong Kong’s economy was booming, and the need for a more unified financial market became clear. In 1986, four existing stock exchanges—Hong Kong Stock Exchange, Far East Exchange, Kam Ngan Stock Exchange, and Kowloon Stock Exchange—merged to form a single, centralized exchange, known as The Stock Exchange of Hong Kong (SEHK). This was a turning point, modernizing Hong Kong’s financial sector and attracting global investors.

Modernization and Global Influence (1990s – Present)

The Hong Kong Stock Exchange continued to grow, adopting electronic trading systems in the 1990s and expanding its market internationally. In 2000, SEHK merged with the Hong Kong Futures Exchange and Hong Kong Securities Clearing Company to form the Hong Kong Exchanges and Clearing Limited (HKEX), which operates today.

With a strong connection to mainland China, HKEX became the primary listing destination for Chinese companies, particularly after the launch of the Shanghai-Hong Kong Stock Connect in 2014. Today, HKEX is one of the largest stock exchanges globally, serving as a vital bridge between China and international markets.