The New York Stock Exchange (NYSE) is the largest and most influential stock exchange in the world. Established over 230 years ago, the NYSE has played a crucial role in shaping global finance, reflecting economic trends, and evolving with technological advancements.

Early Beginnings (1792–1865)

The origins of the NYSE date back to May 17, 1792, when 24 stockbrokers signed the Buttonwood Agreement under a buttonwood tree on Wall Street in New York City. This agreement laid the foundation for a structured securities market. Initially, trading was informal, taking place in coffee houses. By 1817, the traders formed the New York Stock & Exchange Board, establishing rules for stock transactions.

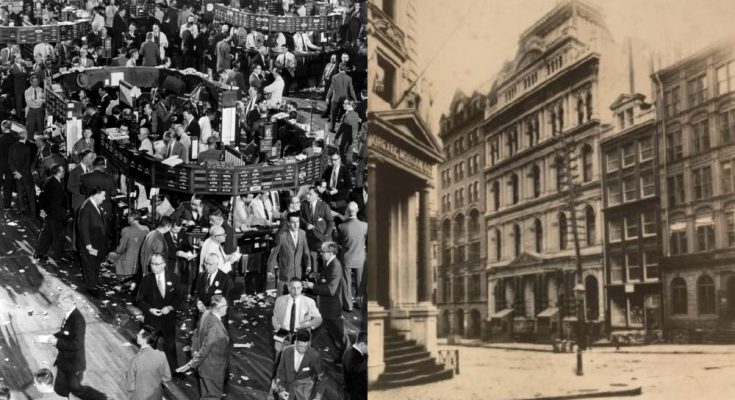

During the 19th century, the NYSE expanded as industrialization grew. The Erie Railroad, one of the first major publicly traded companies, attracted significant investor interest. By 1865, the NYSE moved to its first permanent location on Broad Street in Manhattan.

Growth and Industrial Expansion (1865–1929)

The late 19th and early 20th centuries saw massive growth, fueled by the rise of railroads, steel, oil, and banking industries. Key companies such as Standard Oil (John D. Rockefeller) and U.S. Steel (Andrew Carnegie) were listed, making the NYSE a hub for economic expansion.

However, with growth came volatility. The Panic of 1907, triggered by bank failures, led to calls for financial reform and the eventual creation of the Federal Reserve in 1913.

The Great Depression and Market Reforms (1929–1945)

On October 29, 1929 (Black Tuesday), the stock market crashed, wiping out billions in wealth and triggering the Great Depression. The collapse exposed weaknesses in the financial system, leading to regulatory changes such as the Securities Act of 1933 and the creation of the Securities and Exchange Commission (SEC) in 1934 to oversee trading practices.

Post-War Boom and Technological Innovations (1945–2000)

After World War II, the NYSE became the centerpiece of American capitalism. Companies like IBM, Coca-Cola, and General Motors helped drive stock market growth. By the 1970s, the introduction of electronic trading systems improved efficiency.

The 1987 Black Monday crash, when the Dow Jones dropped 22% in a day, led to the adoption of circuit breakers, mechanisms designed to prevent extreme volatility.

Modern Era and Challenges (2000–Present)

The dot-com bubble (2000), the 2008 financial crisis, and the COVID-19 pandemic (2020) all tested the resilience of the NYSE. Despite these challenges, it remains the world’s leading stock exchange, handling trillions in daily transactions and listing global giants like Apple, Amazon, and Microsoft.

Today, the NYSE continues to adapt, incorporating AI-driven trading, blockchain technology, and high-frequency trading, ensuring its relevance in a rapidly evolving financial landscape.